It’s quite not that time of the year when investors start actively looking to save taxes under Section 80C of the Income Tax Act. But it’s best to start early and avoid making choices in a hurry. Tax-saving mutual funds, which have a lock-in period of just three years, are the perfect route to save taxes while still generating healthy, inflation beating returns over the long term. Moreover, they are among the best vehicles to get a dual tax advantage – one, deduction from income at the time of investing the principal, and two, capital gains exemption at the time of redeeming the investment.

Rs.1 lakh invested in HDFC Tax Saver in March 1996 is worth Rs. 94.32 lakhs as on September 2015.

Money multiplied by 94 times in 19+ years. This works out an annualised return of 26.24%.

These are facts, not fiction.

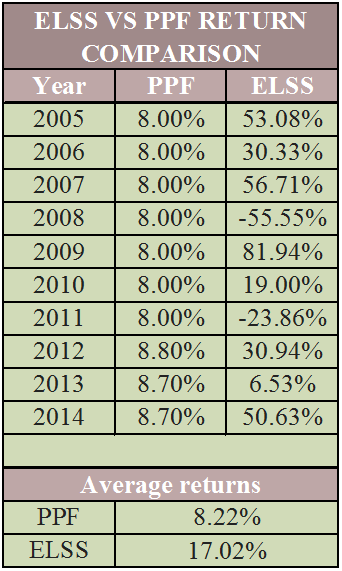

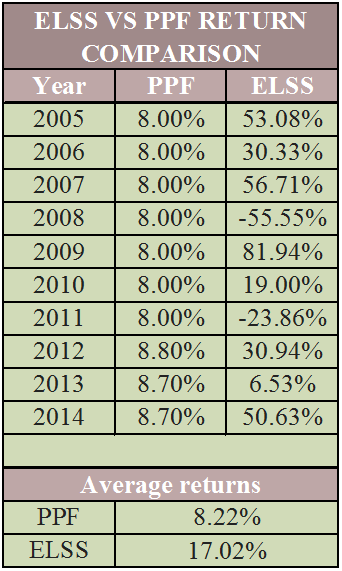

ELSS VS PPF RETURN COMPARISON

Please feel free to contact us on 8693800025 or email us at ark.advisor@gmail.com incase you have any queries or to invest in TAX SAVING Funds.

Regards

Raj